Top Heavy Equipment Manufacturers in World and Market Insight

Order intake for major heavy equipment manufacturers has begun to increase, but will this also reflect in their revenue and profit statement? not necessary. The effect of COVID-19 is still intact, but it is a relief that we are now very close to getting the vaccine.

This ray of hope is bringing the market back on track and the construction industry is expecting to see daylight over the next 2-3 months, which was buried under the clouds of speculation.

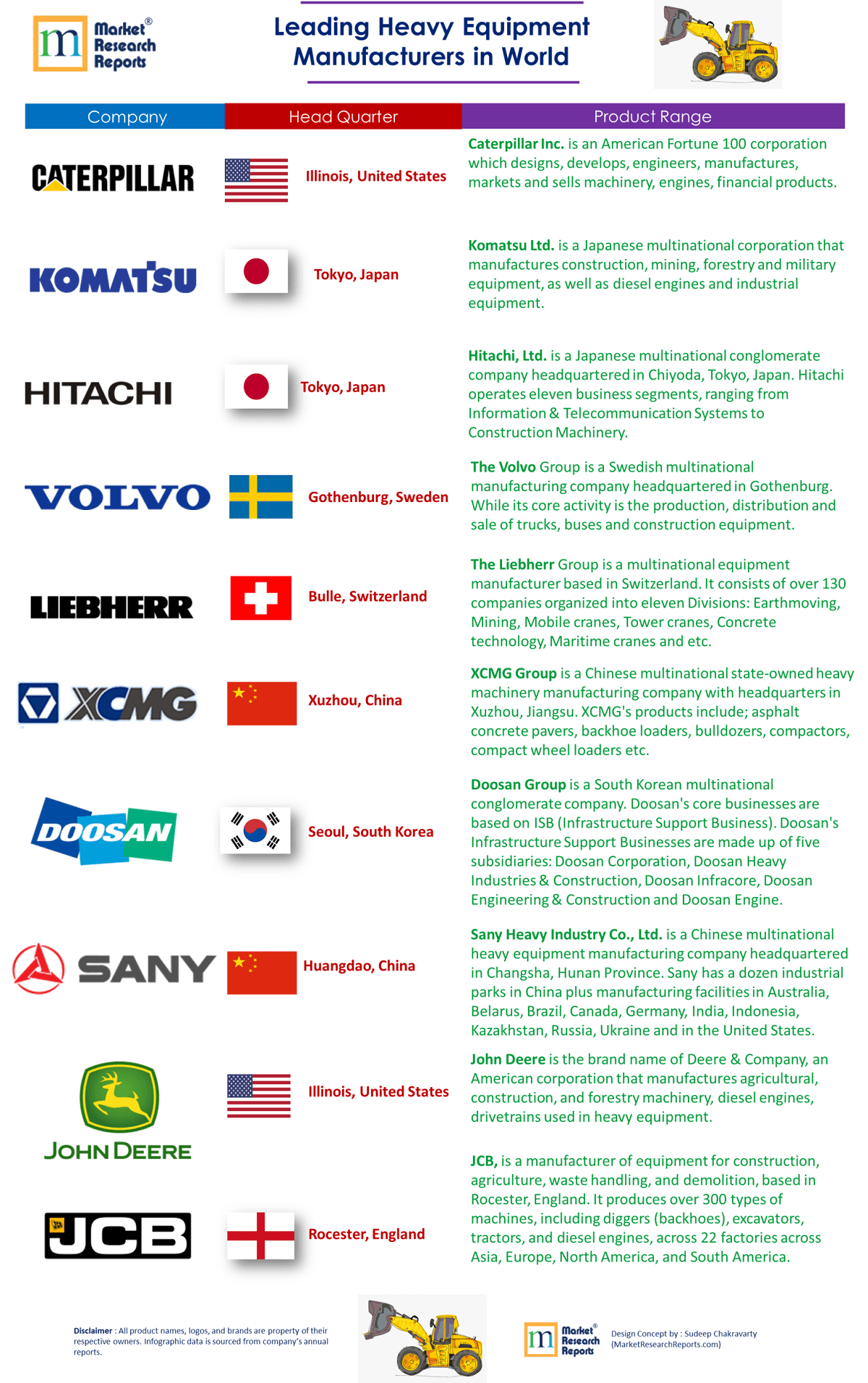

1 . Top 10 Heavy Equipment Manufacturers in World

- Caterpillar

- Komatsu

- Hitachi Construction Machinery

- Volvo Construction Equipment

- Liebherr

- XCMG

- Doosan Infracore

- Sany

- John Deere

- JCB

2 . Heavy Equipment Market Scenario

In 2019, the global Heavy Equipment market size was US$ 481150 million and it is expected to reach US$ 611720 million by the end of 2026, with a CAGR of 3.5% during 2021-2026.

All major manufacturers are working at almost 30-50% capacity. COVID has completely changed the way of doing business. Social distancing, safety gears, sanitization, and limited factory work hours have now become the new standards of the manufacturing industry. This entire situation can take almost a year to normalize, and accordingly, our previous market forecast could also change.

Get insights on historical data and future market sizing. Regional/country-level market data along with the competitive scenario of heavy equipment industry.

3 . Performance of Leading Players in the Heavy Equipment Industry

1. Caterpillar Inc.

2. Komatsu Ltd.

In the construction, mining and utility equipment business, demand declined in Strategic Markets, centering on Asia, and in some other regions, as adversely affected by the coronavirus (COVID-19) pandemic in the fourth quarter. As a result, sales decreased from the previous fiscal year.

3. Hitachi Ltd.

For Fiscal 2019 the Hitachi’s consolidated revenues decreased 8% year over year, to 8767.2 billion yen. In addition to the decrease in the revenue due to the COVID-19 impact in all the segments the decreasing male in it at his metal segment where sales were affected by a decrease in automobile and semiconductor and factory automation.

4. Volvo CE

The second quarter of 2020 was characterized by the COVID-19 pandemic and its negative effects on society and economic development. Apart from Asia Construction Equipment segment has declined in terms of the order value for all other major markets.

5. Liebherr Group

Growth was evenly distributed among the Construction Machines and Mining divisions, along with the other product areas. The Group’s sales in construction and mining machinery reached € 7,640 million, an € 807 million (11.8 %) increase compared to the year before. This included the Earthmoving, Mobile Cranes, Tower Cranes, Concrete Technology and Mining. For the other product areas, including the Maritime Cranes, Aerospace and Transportation Systems, Machine Tools and Automation Systems, Household Appliances as well as the Components and Hotels divisions, combined sales reached € 4,110 million, a € 392 million (10.5 %) increase over the year before.

6. XCMG Group

The total sales of China-based XCMG on was nearly USD 12 billion, which is about 5.6% of the total from last year.

Related Reports

Covid-19 Impact on Global Heavy Equipment Rental Market Size, Status and Forecast 2020-2026

Impact of COVID-19 Outbreak on Heavy Duty Construction Equipment, Global Market Research Report 2020

Global Construction Vehicles Market Research Report 2020-2024

Global Earthmoving Equipment Market Research Report 2020

Global Backhoe Loader Market Growth 2020-2025

Scrapers, Rollers & Construction Machinery for Mounting on Tractors South America Report & Database

Impact of COVID-19 Outbreak on Heavy Duty Construction Equipment, Global Market Research Report 2020

7. Doosan Group

8. Sany Heavy Industry Co. Ltd.

Last year, SANY achieved USD 2.002 billion international sales revenue, up 3.96% year on year, with rapid growth in Indonesia, USA, Europe, Russia, and Latin America.

9. John Deere

10. JCB

India remained JCB’s largest market in 2018 and this year marks the 40th anniversary of JCB India and comes as the company invests in a new £65 million factory in Gujarat, which is due to open in 2020.

Related Industry Articles

1. The Top Elevators and Escalators Manufacturers

2. Top Construction Equipment Manufacturers in World and Market Insight

3. Top Mining Equipment Manufacturers in World and Market Insight

[2]home.komatsu/en/ir/library/annual/

[3]investor.deere.com/home/default.aspx

[4]xcmg.com/en-na/news/news-detail-617664.htm

[5]prnewswire.com/news-releases/a-year-of-records--highlights-from-the-sany-2019-annual-report-301051489.html

[6]volvogroup.com/content/dam/volvo/volvo-group/markets/global/en-en/investors/reports-and-presentations/interim-reports/2020/volvo_20q2_presentation_material.pdf

[7]liebherr.com/en/ind/about-liebherr/company-profile/dates-facts/facts-and-figures.html

[8]prnewswire.com/in/news-releases/zoomlion-reports-first-quarter-2020-results-810064892.html